Welcome readers,

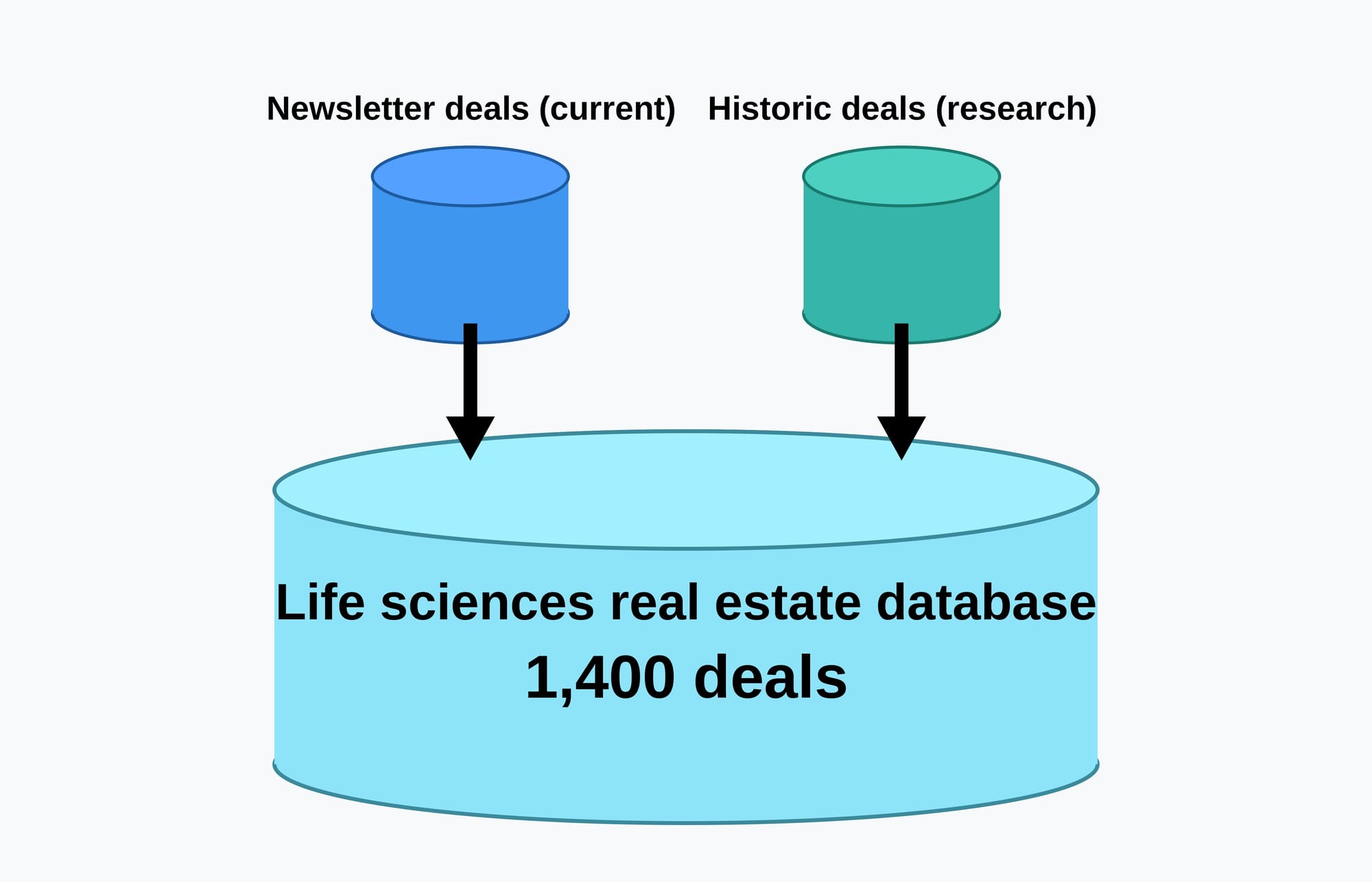

This edition spans 8 European markets with 16 deals showcasing life sciences momentum. Standout UK projects include Hines' £400 million Birmingham partnership and the Crown Estate's £4.5 billion Harwell development. AEW's pan-European core fund acquisition in Munich signals growing institutional confidence in German life sciences real estate. From Norway's new hospital and adjacent health park to Latvia's medical technology expansion, the breadth is remarkable. Our lead article explores how newsletter deals and historic transactions combine to feed our expanding database.

🔒 Paying subscribers get 16 deals • Everyone else can explore 3 of them → Get full access by subscribing here.

— Stephen Ryan (connect with me on LinkedIn)

🔍 Do you need deeper insights into life sciences real estate?

In addition to our regular updates, we offer bespoke research and strategic analysis for investors and developers in the life sciences sector. Whether you’re evaluating an acquisition, tracking market trends, or need a custom report, our team can help you make informed decisions.

Get in touch to discuss how we can support your next project.

Featured article of the week

Building transparency in Europe’s life sciences real estate

With 1,400 verified deals mapped across Europe, our database brings new transparency to the fast-growing life sciences real estate market.

Deals

GERMANY HAMBURG

CLS Holdings has sold a medical office building with approximately 5,000 sq m of rental space in the Winterhude area of Hamburg to Values Real Estate. The property has been acquired by the specialist fund Values Health Invest I, which focuses its investment strategy on medical office buildings and medical care centres across Germany. Taylor Wessing, led by Hamburg-based partner Dr Daniel Graske, provided legal advice to the seller on the transaction.

GERMANY MUNICH

Aventin Real Estate has sold a 10,900 sq m life science centre in Gräfelfing, near Munich, to a pan-European core fund managed by AEW. The research facility is fully let on long-term leases to three international biotech companies. It offers flexible, third-party-compatible floor plans with S1 and S2 laboratories alongside office space. Situated within the Bavarian biotech cluster, the property reportedly changed hands for around €70 million, according to market sources.

Would you like instant access to more deals like these? Our data tool lets you filter, sort and search European life sciences transactions spanning 24 countries—whether you're tracking a single city or spotting market patterns others miss.

GERMANY MUNICH

Invicon diagnostic concepts has signed a long-term lease for laboratory and office space at Floriansbogen 4 in Neuried, a suburb of Munich. The property is owned by Physicus Life Science Real Estate. Invicon produces and distributes stable third-party quality controls and reagents for clinical chemistry, protein diagnostics, immunochemistry and molecular diagnostics. JLL Germany, BNP Paribas Real Estate and Eubag advised on the transaction.

👇 As a free member, you get access to three deals for free.

Upgrade now to access the full list.