This newsletter is presented by Life Sciences & Research Clusters Conference (more details below)

Dear reader,

This week we're unpacking vertical labs, hearing from Javier García Cogorro on Spain's life sciences campuses, exploring why four European innovation hubs chose the same name, and meeting the Dutch draper who invented home biotech 350 years ago.

Ready? Let's dive in.

✅ Labs in the sky: high-rise is here

✅ Industry voice: Javier García Cogorro

🔒 Nexus: four buildings, one name

🔒 Delft's draper: 350 years of home-based biotech

(🔒 items are for paying members only)

Our signature deal tracker returns on 12 June.

— Stephen Ryan (connect with me on LinkedIn)

Embracing high-rise labs

Following our recent analysis on London's embrace of high-rise laboratory developments, the transformation of the city's life sciences landscape presents striking parallels with pioneering work across the Atlantic. As London advances ambitious projects such as the Euston Tower redevelopment and the forthcoming One North Quay development in Canary Wharf, these initiatives echo earlier innovations in Boston.

A useful comparison is Boston's Center for Life Science Boston (CLSB), located at 3 Blackfan Circle in the Longwood Medical Area. This 22-storey, 776,000-square-foot facility is recognised as the first purpose-built, speculative high-rise laboratory building in the United States.

The driving force behind CLSB was BioMed Realty, a specialist life sciences real estate company that has since become a significant player in the UK market. BioMed Realty's UK portfolio now encompasses over 870,000 square feet across major sites including Granta Park and the Babraham Research Campus, supporting companies at various stages of development.

Transatlantic expertise and market expansion

BioMed Realty's transatlantic presence illustrates the evolution of life sciences real estate. Having demonstrated the viability of high-rise laboratory development through CLSB in Boston, the company has applied these lessons to its UK expansion. Their recent £850 million (€1 billion) investment programme aims to double their UK portfolio, incorporating acquisitions such as the 15-acre Cambridge International Technology Park and a 27-acre plot at Granta Park. These developments are projected to deliver approximately 800,000 square feet of new laboratory and office space.

The company's UK portfolio already hosts major life sciences organisations including AstraZeneca, Gilead, Illumina, Pfizer, and Cancer Research UK, alongside a dynamic community of early-stage ventures. This tenant mix reflects BioMed Realty's strategic approach to supporting the entire life sciences ecosystem, from start-up incubators to multinational headquarters.

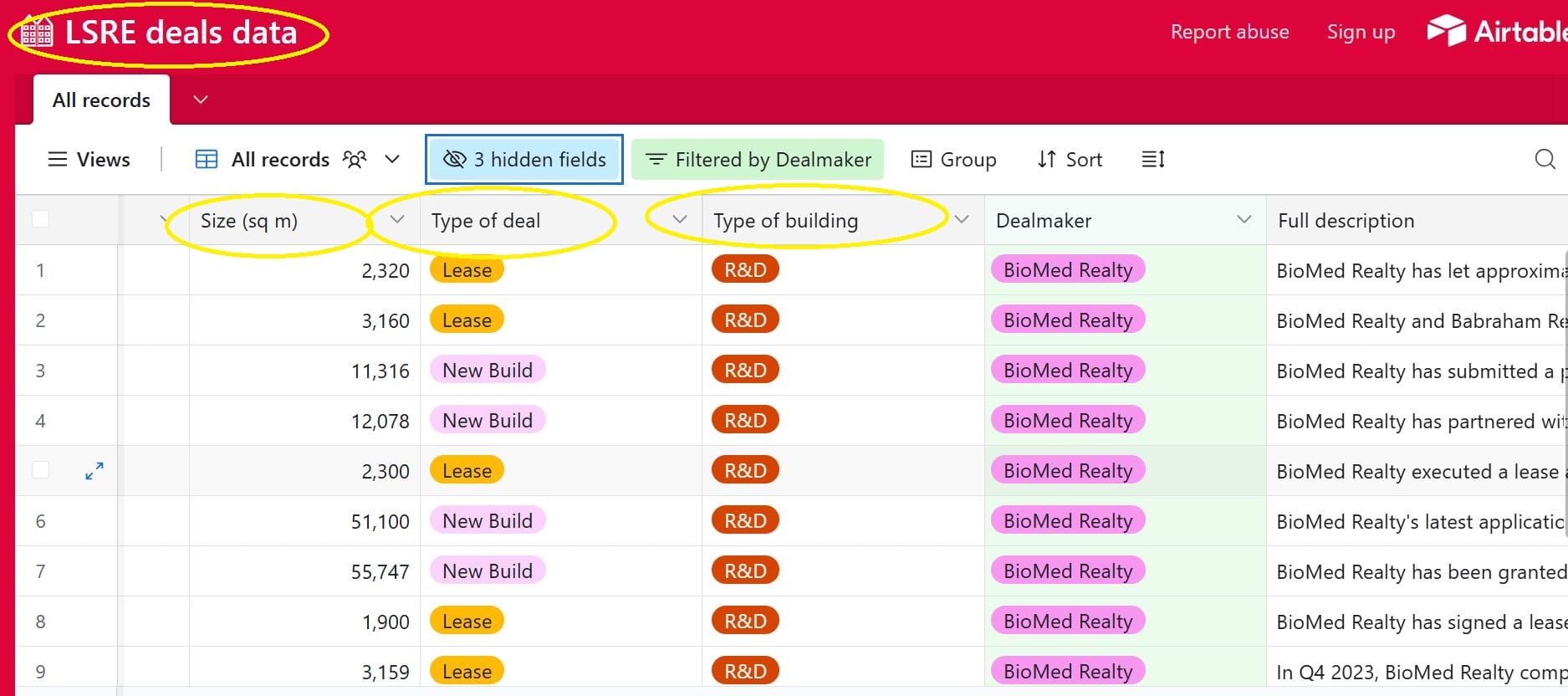

Want to know more about BioMed Realty's deals in the UK? Our deals database contains 1,091 deals across the UK and Europe and the data can be sorted, filtered, and searched very easily. To find deals involving BioMed Realty, just apply the filter "Dealmaker = BioMed Realty" or search for the company's name.

Scale and architectural ambition

The scale of these buildings is impressive. London's redeveloped Euston Tower will rise to 32 storeys, incorporating 215,000 square feet of laboratory space alongside 462,000 square feet of office accommodation. One North Quay, destined to become Europe's tallest purpose-built commercial laboratory building upon completion in 2027, will encompass 823,000 square feet across 23 floors. CLSB's dimensions, whilst marginally smaller, established the template for such ambitious undertakings with its 22 floors dedicated entirely to research and laboratory functions.

The architectural philosophy underlying these developments centres on flexibility and adaptability. CLSB pioneered modular, plug-and-play laboratory systems that accommodate diverse tenant requirements, from leading academic medical institutions to private research enterprises. This approach directly informed the design principles now being implemented at One North Quay, which will feature sophisticated wet laboratories capable of supporting containment level 2 and 3 research, alongside Good Manufacturing Practice facilities. The flexible, lab-enabled spaces planned for Euston Tower similarly reflect this adaptable methodology.

Urban integration and sustainability credentials

The urban integration strategies employed by these high-rise developments represent sophisticated responses to the challenges of dense metropolitan environments. CLSB optimised its constrained urban site by subdividing an existing superblock whilst improving pedestrian access throughout the surrounding area. This approach mirrors the emphasis placed on maximising prime city locations in London's developments: Euston Tower is positioned within Regent's Place and the Knowledge Quarter, whilst One North Quay capitalises on Canary Wharf's transport connectivity, including the Elizabeth Line.

The collaborative ethos underpinning these developments represents perhaps their most significant shared characteristic. CLSB was conceived explicitly to foster interaction among scientists and researchers, creating environments where public and private sector collaboration could flourish naturally. This philosophy directly influences the community spaces and public amenities incorporated into London's towers, acknowledging that scientific advancement increasingly depends upon cross-disciplinary interaction and knowledge exchange.

Market dynamics and timing

The timing of these developments reflects broader market dynamics within the global life sciences sector. CLSB's completion coincided with Boston's emergence as a leading biotechnology hub, establishing infrastructure that supported the city's continued growth in this sector. London's current wave of high-rise laboratory construction responds to similar pressures, as the capital seeks to accommodate burgeoning demand for sophisticated research facilities whilst contending with severe constraints on available land.

Future implications

Dense urban environments can support sophisticated research activities without compromising operational effectiveness. These projects represent responses to the increasing spatial demands of modern life sciences research, coupled with the premium placed on urban locations that provide access to talent and collaborative opportunities.

Not every high-rise lab in Boston has fared as well as CLSB and the promoters of London's two towers will wish to avoid the fate of buildings such as 601 Congress Street, the former headquarters of the life insurance company John Hancock, which was converted to lab space but remained entirely empty as of 2024.

Join the Life Sciences & Research Clusters Conference & Awards, taking place on 24 June at the Hilton Bankside in London, and dive deep into the latest trends and innovations shaping the future of lab spaces and technology real estate. Book now!

Industry voice: Javier García Cogorro

Javier García Cogorro began his career in information technology as an entrepreneur before spending 25 years at Eli Lilly, rising to Vice President of Business Development with responsibility for innovation licensing and acquisition. After working as an independent biotech consultant from 2012, he co-founded Columbus Venture Partners in 2015, now managing over $450 million across four funds. As CEO of Viralgen Vector Core—acquired by Bayer as part of the Askbio acquisition for $4 billion in 2020—he addressed critical gene therapy manufacturing bottlenecks through advanced adeno-associated virus (AAV) production capacity and cutting-edge technology.

He served as chairman of Viralgen from January 2022 to April 2025. As president of Columbus Venture Partners, García Cogorro is spearheading SOKAI HUB España through a partnership with Quercus Investments. This major initiative aims to create life sciences innovation campuses across Spain, with assets already acquired in San Sebastián and Madrid, and a third site under negotiation in Granada.

In a nutshell, I believe my role is to bring together intellectual and traditional capital to produce genuine innovation. Differentiating infrastructure is key to attracting investors and entrepreneurs.