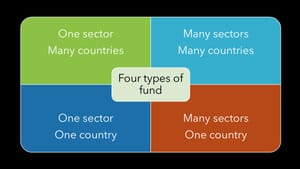

Life sciences real estate (LSRE) now features within a range of European investment vehicles. These funds differ in geographical scope, sector focus, and investment style, yet all have committed capital to LSRE assets. The following eight examples illustrate the broad appeal of such assets across the country and sector spectrum.

GROUP 1: multi-country, sector-specialist funds

Cross-border scale within a defined sector

Funds with a multi-country mandate and a life sciences or healthcare specialism combine thematic focus with geographical reach.

The first example is Kadans Science Partner, a platform owned by AXA IM Alts, which has acquired and redeveloped science assets in several European markets, including two assets in Malaga Tech Park. NODE I is an 11,200 sq m multi-tenant development completing in Q4 2025 and targeting microchips, AI, and life sciences tenants. It offers flexible space for clean rooms, labs, and offices, plus shared facilities and a central patio. NODE II, located 300 m away, is a renovated 4,000 sq m property acquired from Babel in late 2023, now 80 per cent let to Babel and Ilkari data centres.

The second example is Atland Voisin’s Épargne Pierre Sophia, a French SCPI with a multi-country strategy that targets healthcare and life sciences assets. In 2025, it bought a 2,365 sq m rehabilitation clinic in Meaux near Paris for €3.5 million. The asset is subject to a 12-year firm lease with LNA Santé, consistent with a core-plus profile. The SCPI invests primarily in the Eurozone with additional exposure to the United Kingdom and Switzerland.

These two examples show how multi-country, single-sector vehicles focus on LSRE to deliver either value creation through redevelopment or income stability through long-lease operations.

Our paid members get full access to all case studies and analysis — including how AEW, Fidelity, Swiss Life and UBS are investing in life sciences real estate.

Upgrade now to continue reading.