Addressing a long-standing data gap

Europe’s life sciences real estate sector has long suffered from a lack of transparency. While residential and office markets benefit from established data providers and regular reporting, this fast-growing niche—worth billions of euros—has been far less well documented. Investors, developers, occupiers and advisers have been forced to rely on fragmented information, anecdotal evidence and their own networks to understand market dynamics. That opacity is changing.

Since March 2022, Life Sciences Real Estate has been systematically documenting transactions across Europe through its regular newsletter coverage. Each deal is converted into a standardised summary capturing key details—location, size, value, lease terms and the parties involved—and added to a database that now holds 1,226 entries covering more than 26 million square metres of space. The database is filterable and searchable, either by key parameters such as location, deal type, value, size, date and lead entity, or through free-text search.

Beyond newsletter coverage

But newsletter coverage alone has limitations. A bi-weekly or quarterly publication cycle means that only the most recent deals—those concluded in the preceding weeks or months—make it into print. Older transactions, even if they occurred just a few quarters ago, quickly become stale news. This creates a significant gap in the historical record. For a sector as young and dynamic as life sciences real estate, where comparable transactions are scarce, the absence of historical data could be a handicap.

Recognising this, Life Sciences Real Estate has adopted a dual-source approach to database construction. In addition to published summary deals from our regular newsletter coverage, the team actively gathers older deals—transactions that may have occurred several quarters or even years ago. These historic deals are not sufficiently recent to merit publication in a newsletter but remain of considerable interest to those analysing pricing trends, lease structures, preferred locations and the evolution of the market over time.

Through a mix of data mining and fieldwork, the team pieces together evidence from developers, investors, agents, laboratory fit-out specialists, science parks, biotech experts and architects—supplemented by insights gathered at industry events—to uncover transactions that might otherwise slip through the cracks. Each deal is then reconstructed in the same standardised format used across the database, ensuring consistency and comparability over time. The result is a resource growing much faster than the flow of new deals alone would allow.

November refresh brings total to over 1,400 deals

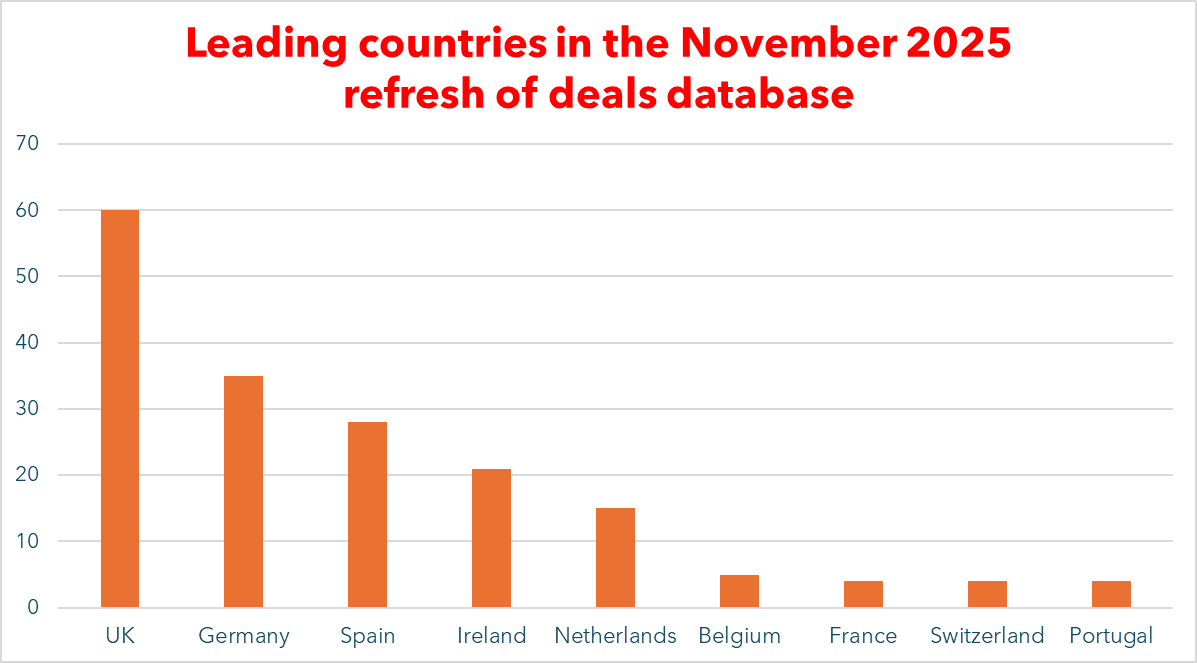

The next database refresh, scheduled for November 2025, will add over 180 deals—a mixture of recent transactions captured through newsletter coverage and older deals retrieved through systematic research. This update will bring the total number of deals to over 1,400, cementing its position as the most comprehensive shared record of life sciences real estate transactions in Europe.

The benefits for the market are considerable. For investors and developers, the database provides a reliable way to benchmark valuations, identify active players, and track emerging clusters across Europe. It highlights who is buying, building or funding life sciences space—a valuable resource for anyone seeking to understand the competitive landscape or identify potential clients and partners. Advisers use it to demonstrate market knowledge and to target mandates with precision. As one expert puts it, it shows “who’s who in the zoo”—transforming transparency into actionable market intelligence.

Use cases across the market

The applications are already evident. Market entrants use the “Dealmakers” field to identify potential partners—the agents, developers and investors most active in the sector. Investors and developers drill into the data to compare opportunities and gauge their own positioning relative to peers. Researchers rely on the comprehensive dataset to identify emerging trends, validate market hypotheses, and accelerate reporting.

The November 2025 refresh will reinforce these capabilities. With over 1,400 deals spanning multiple years and dozens of cities across Europe, patterns become visible that would be impossible to discern from a smaller or more fragmented dataset. Which cities are attracting the most investment? How have capital values changed over time? What are typical lease lengths for laboratory space? Who is the most active purchaser/developer in the market? These questions, and many others, can now be answered with data rather than guesswork.

A milestone for market transparency

The expansion of the database also reflects the maturation of the life sciences real estate sector itself. What was once a niche curiosity—laboratory buildings clustered around a handful of university towns—has become a recognised asset class attracting institutional capital, specialist developers and dedicated funds. As the sector has grown, so too has the need for transparency and standardised reporting.

The November 2025 refresh represents a significant milestone. As life sciences real estate in Europe continues its expansion, the availability of reliable, comparable transaction data will be essential to informed decision-making. The database delivers exactly that.