Introduction: a targeted investment band

European life sciences real estate (LSRE) presents a striking diversity of opportunities. For investors, the range between €5 million and €10 million is particularly interesting. It is narrow enough to suggest a specific investment strategy, yet broad enough to capture a wide variety of typologies, locations, and occupiers.

An analysis of 46 transactions completed over the past five years highlights how investors have positioned themselves in this band. The findings reveal not only which assets attract capital, but also how these differ from larger-scale acquisitions exceeding €10 million.

Deal sizes and investor behaviour

Deal activity is well distributed across the bracket, with transactions occurring in every €1 million increment between €5 million and €10 million. Yet the €7 million to €8 million range has emerged as the most active, accounting for 26 per cent of observed deals. By contrast, the lowest bracket (€5 million to €6 million) represents just 11 per cent of the sample.

This pattern shows investors gravitating toward the band's midpoint, finding assets large enough for operational efficiency but small enough to avoid syndication requirements.

Typologies: patient-facing and innovation-driven assets

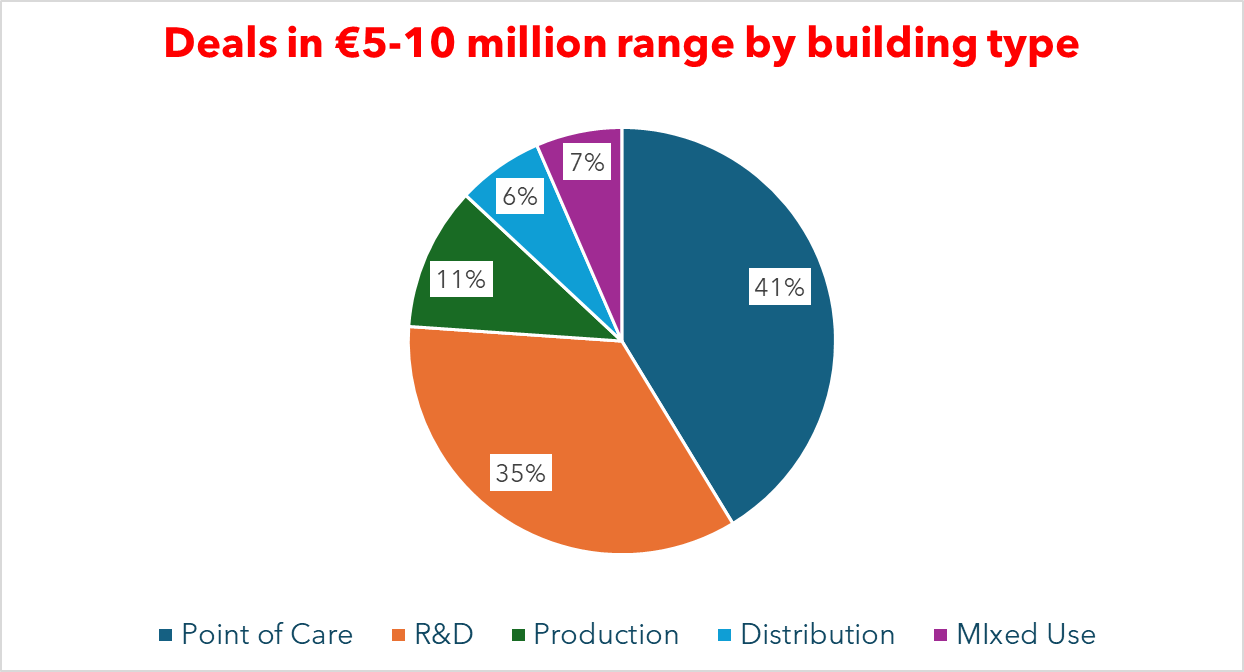

When broken down by building type, point of care facilities dominate this segment, representing 41 per cent of transactions. These include medical clinics and diagnostic centres. Investors are drawn by stable occupancy, demographic-driven demand, and the ability to secure long leases with healthcare operators.

Research and development (R&D) buildings make up 35 per cent of the dataset. These properties are closely tied to innovation pipelines, offering opportunities to capture value growth as tenant companies expand and attract capital.

The remaining 24 per cent is divided between production (11 per cent), mixed-use (7 per cent) and distribution buildings (6 per cent). While smaller in share, these categories broaden the investment universe, providing exposure to manufacturing supply chains, logistics, and hybrid spaces serving medtech occupiers.

Comparison with larger deal sizes

Notably, when looking at deals above €10 million, the pattern shifts: point of care assets fall to just 15 per cent of transactions, while R&D rises sharply to 47 per cent. The comparison highlights that patient-facing facilities are more accessible at lower lot sizes, while larger-scale innovation campuses are favoured at higher levels of investment.

Geographic concentration and market contrasts

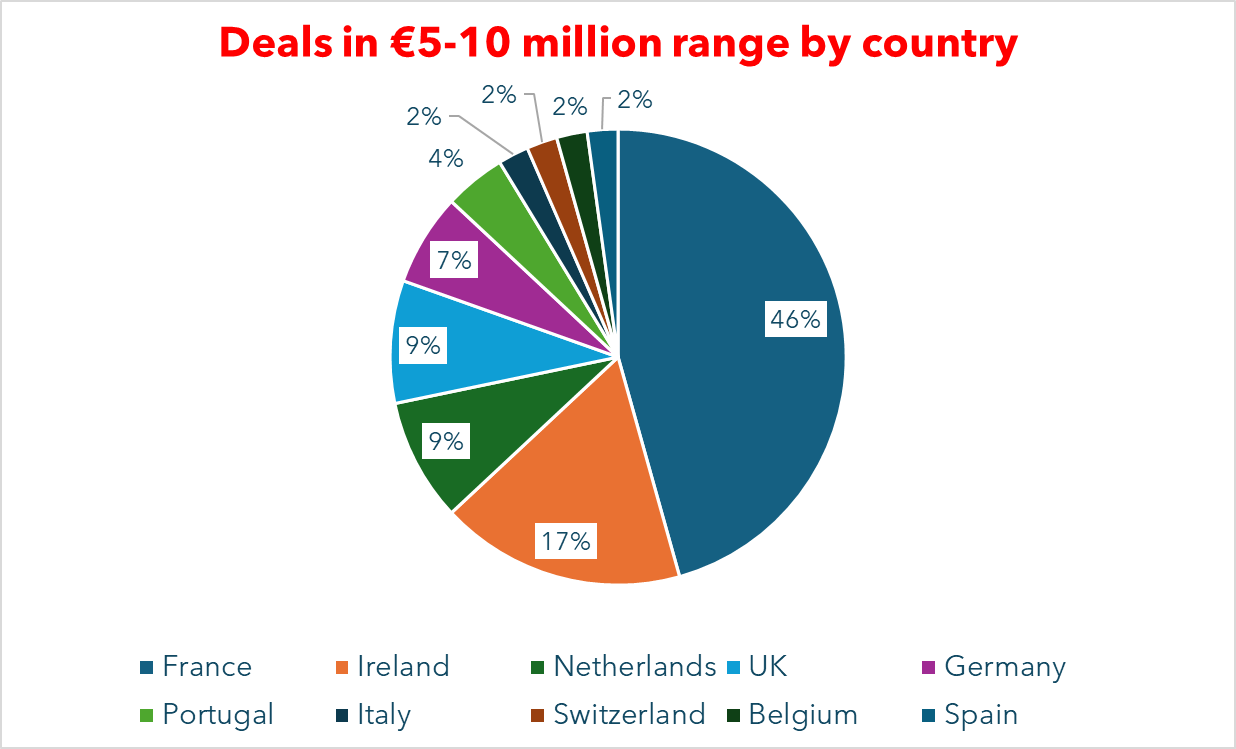

The dataset is geographically skewed towards France, which alone accounts for 46 per cent of deals in the €5–10 million range. Ireland follows with 17 per cent, while the Netherlands and the UK each represent 9 per cent. Germany’s share is 7 per cent, with Portugal, Italy, Switzerland, Belgium, and Spain together making up the remaining 12 per cent.

This national pattern reflects both asset availability and investor preferences. France is home to a large network of mid-sized healthcare facilities, frequently acquired by healthcare-focused funds. Ireland, meanwhile, has seen significant investment in medtech-linked real estate, particularly around Galway’s manufacturing clusters.

Comparison with larger deal sizes

The geographic spread looks quite different at higher price points. For transactions above €10 million, the UK and Germany dominate, representing 34 per cent and 26 per cent respectively.

Illustrative transactions in the €5–10 million range

Three examples highlight the variety of opportunities open to investors in this bracket:

French point of care facility

In late 2022, SCPI Pierval Santé forward purchased a medical centre at 73 rue de Stalingrad in Saint-Nazaire, near Nantes, for €7.9 million. Extending to nearly 3,000 square metres, the building is operated by Medic Global and illustrates the appeal of regional healthcare assets offering stable, long-term cash flows.

R&D building near Paris

In 2021, French listed biotech company Neovacs acquired the former Servier laboratory building in Suresnes, nine kilometres west of central Paris, for €8.9 million. With a floor area of 5,000 square metres, the property consolidates Neovacs’s teams and hosts other biotech and medtech tenants. The deal shows how even listed companies in growth sectors find opportunities at this scale.

Mixed-use medtech facility in Galway

In Q3 2025, French investor Atland Voisin purchased Building 1 at Parkmore West Business Park, Galway, for €7.2 million. The property, comprising 5,751 square metres of manufacturing and warehouse space, is fully let to Celestica Inc under a lease extending to 2030. Celestica’s Galway operations directly support Medtronic, providing assembly and supply chain services. With a passing rent of €520,000 per year and a parent company guarantee from a Nasdaq-listed corporation, the investment demonstrates how €5–10 million can secure exposure to multinational medtech production.

Conclusion: variety within a narrow bracket

Although €5 million to €10 million represents a narrow investment band, it encompasses a broad spectrum of LSRE opportunities. The clustering of activity at €7–8 million suggests that this is a natural equilibrium point for investors seeking balance between scale and manageability.

Point of care and R&D facilities dominate, underlining the sector’s dual focus on patient-facing infrastructure and innovation capacity. France and Ireland are most active, yet sufficient activity elsewhere provides good geographic representation across the sample.

The analysis shows that investors can participate in very different parts of the LSRE value chain—whether acquiring regional medical centres, urban laboratories, or medtech-linked industrial units—while committing similar levels of capital. This variety makes the €5–10 million range particularly attractive to mid-sized funds, cross-border investors, and institutions seeking portfolio diversification without venturing into the larger ticket-size deals.