Originally published by Institutional Real Estate, Inc. in its EUROPE | 18 | FEBRUARY 2025 edition

European life sciences real estate is increasingly recognised as a reliable source of long-term, secure income. Many top global managers are pursuing core strategies within this growing sector, underpinned by robust tenant demand and longer-than-average lease lengths.

IPE Real Assets’ list of the top 150 real estate investment managers reveals that 40 out of 150 monitored managers are active in European life sciences real estate. Interestingly, these 40 show a strong emphasis on core and core-plus strategies, with fewer players adopting value-added or opportunistic approaches. This indicates that many large managers perceive the sector as mature enough to prioritise stabilised assets over high-risk investments.

This is corroborated when speaking to managers.

For example, when asked to compare life sciences real estate to more traditional sectors such as CBD office — in terms of stability of income — Maarten Frouws, European portfolio manager at Fidelity International responded:

“We believe the income is equally stable, and on average has the potential to deliver higher rental growth.”

Gauging income security

Research firm Life Sciences Real Estate breaks down the sector’s real estate ecosystem into five distinct categories: R&D/labs, production, distribution, point of care, and mixed-use/flexible facilities. Each category exhibits unique leasing dynamics.

In order to calculate lease lengths and tenant security across the five main types of life sciences real estate, Life Sciences Real Estate combines its own data with data from Income Analytics. The UK-based fintech company enables investors to assess tenant risk through its proprietary tenant income risk measures. These estimate the probability of default scores and then calculate the equivalent bond risk rating.

“Accurately pricing income default risk is crucial for investors, lenders and other real estate professionals when making investment and lending decisions,” says Matthew Richardson, co-founder and CEO of Income Analytics. “However, this often amounts to little more than a cursory glance at a company credit report,” he adds.

In contrast, the company’s INCANS Tenant Global Score helps go beyond a superficial inspection of tenant covenants. The tool is a normalised international cross-border score that predicts the likelihood a company will seek credit relief or, worse, go out of business within the next 12 months. It also a provides a longer term probability of default or failure for up to 10 years into the future. The scale is based on the historical default data from every company over recent history. A higher score indicates a lower probability of failure or default. A score of 100 out of 100 means the company is broadly in the top 1 percent of all global companies that have existed over modern history.

The tenant equivalent bond default risk is then worked out by mapping the INCANS score for probability of failure tool to the historical actual default rates for corporate bonds of different ratings. Corporate bonds with a rating of BBB and above are generally treated as investment grade.

Longer leases

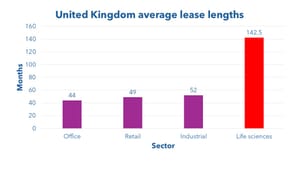

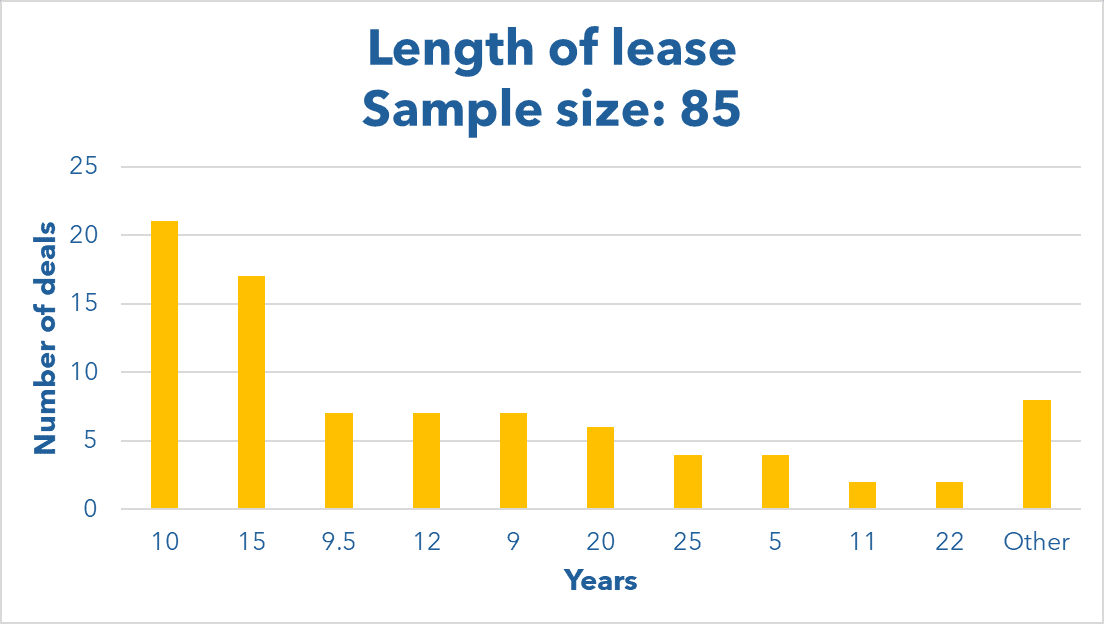

Across 85 leases in the life sciences sector, the average term is 12.6 years, with 10-year and 15-year agreements dominating, according to research firm Life Sciences Real Estate. This contrasts sharply with traditional UK sectors, where average leases are significantly shorter — just 44 months for offices, 49 months for retail and 52 months for logistics.

Lease lengths vary by building type, reflecting their differing operational needs:

- R&D/Labs: 11.6 years — driven by demand for adaptable spaces

- Production: 15.0 years — reflecting high capital investment in specialised facilities

- Distribution: 12.1 years — more standardised terms for logistics hubs

- Point of Care: 13.5 years — geared towards healthcare service stability

Examples of secure life sciences tenants from Life Sciences Real Estate database

In the R&D/labs subsector, in Oxford, in the United Kingdom, Nucleome Therapeutics has committed to a 10-year lease for 20,000 square feet (1,860 square metres) of fitted lab and office space at Mission Street and BGO’s Inventa scheme, relocating from Oxford Science Park. The company’s INCANS Tenant Global Score is 99, and the 12-month equivalent bond default risk rating is A–.

In 2024, ViaNautis Bio Limited took 10,825 square feet (1,010 square metres) of space at Unity Campus in Cambridge. The nanomedicine company signed a 10-year lease on the first floor within the Cadence building. Its INCANS Tenant Global Score is 99, and the 12-month equivalent bond default risk rating is AA–.

Within the production segment of life sciences, in Germany, Nuvisan extended its lease until 2033 at Science Park Lab City in Neu-Ulm, where it operates GMP-certified production of radiolabelled active ingredients across some 129,000 square feet (12,000 square metres) of space. The company’s INCANS Tenant Global Score is 97, and the 12-month equivalent bond default risk rating is A.

And in 2023, Kadans Science Partner agreed to a £4.5 million (€5.1 million) sale-and-leaseback deal for Harrow House in Oxford, a purpose-built manufacturing facility which was leased back in its entirety to Oxford Biomedica. Oxford Biomedica has a INCANS Tenant Global Score of 95, and the 12-month equivalent bond default risk rating is A–. It is a viral vector contract development and manufacturing organisation (CDMO), providing development and manufacturing expertise to pharmaceutical and biotechnology companies.

Within the distribution category, Movianto UK, a pharma supply specialist has an INCANS Tenant Global Score of 53, with its 12-month equivalent bond default risk rating being BB. Movianto recently committed to a 15-year lease on a 381,000-square-foot (35,400-square-metre) logistics facility in Haydock, in the United Kingdom.

In 2023, M7 Real Estate let around 8,500 square metres (91,500 square feet) of space at its multi-let warehouse asset, Litauen Allé 4, in Taastrup, an established distribution hub near Copenhagen, to Heka Dental, the leading supplier of dental treatment centres in Scandinavia. Heka signed an 11-year lease to occupy an entire unit. The company’s INCANS Tenant Global Score is 88 and the 12-month equivalent bond default risk rating is BBB.

In Dublin, Laya Healthcare, which operates in the point-of-care segment, committed to a 25-year lease on a newly refurbished 25,000-square-foot (2,300-square-metre) primary care facility in Cherrywood. The company’s INCANS Tenant Global Score is 94, and the 12-month equivalent bond default risk rating is BBB+.

AEW bought Clinique du Parc private health facility in Lyon from Primonial REIM France at a cost of €73 million. The clinic is operated by ELSAN Holding and is let on a 12-year lease which took effect in 2023. ELSAN Holding’s INCANS Tenant Global Score is 96 and the 12-month equivalent bond default risk rating is A–.

In the area of mixed-use life sciences real estate, SCIENION has an INCANS Tenant Global Score of 98, and its 12-month equivalent bond default risk rating is A+. The company recently signed a 15-year lease for their new 56,000-square-foot (5,200-square-metre) headquarters in Berlin-Adlershof, combining office, laboratory, storage and production space.

Back in 2023, it was announced that Karrié Project Development would develop around 6,000 square metres (64,600 square feet) of new space for offices, research and production for Xylem Analytics Germany on a 9,300 square-metre (100,000-square- foot) site in Mainz. Xylem Analytics Germany GmbH develops and produces measurement technology and medical technology. Relocation is scheduled for mid-2025. The lease is for 15 years with an option to extend. The company’s INCANS Tenant Global Score is 100, and the 12-month equivalent bond default risk rating is AA+.

Observations about the different categories

R&D facilities such as incubators exhibit the most variable lease structures across the sector. They provide suitable spaces (often shared and on flexible terms), access to specialist equipment and additional incubation services. Where R&D space is needed by more mature companies or institutions, longer leases are seen.

Production buildings are dedicated to the production and manufacturing of life sciences products, including pharmaceuticals, biologics and medical devices. They are often equipped with production lines, clean rooms and quality- control areas and must adhere to strict regulatory standards for manufacturing. Production facilities demonstrate more standardised lease lengths than R&D spaces. Ireland leads with the longest com- mitment, a 25-year lease for a major pharmaceutical manufacturing site. The UK market favours 10-year or 15-year terms, while a lease renewal for a German production facility was for 10 years.

Distribution buildings are specialised warehouses for the storage and distribution of life sciences products, often equipped with cold-chain transportation capabilities. Distribution represents the most standardised segment of the life sciences real estate market in terms of lease length. Ireland and the United Kingdom favour 15-year terms for major logistics facilities, often spanning 6,000 to 26,000 square metres (64,600 to 280,000 square feet). Continental Europe, exemplified by Belgium and Denmark, tends toward shorter terms in the nine-year to 11-year range.

Point of care facilities provide direct healthcare services and retail distribution of pharmaceuticals and are usually equipped with clinical spaces, patient care rooms and dispensing areas. Hospitals and clinics, outpatient care centres and community pharmacies are examples. Point of care facilities show the strongest geographic variation in lease terms, heavily influenced by national healthcare systems. France prefers nine-year to 12-year terms across its medical centres, while the United Kingdom and Ireland favour longer commitments of between 15 years and 26 years, particularly for government-backed tenants.

The life sciences real estate sector offers a compelling combination of extended lease terms and secure income streams, supported by strong tenant fundamentals. With the right analytical tools, such as INCANS scores and equivalent bond ratings, investors can confidently navigate this maturing asset class.

About the authors:

- Stephen Ryan, Founder, Life Sciences Real Estate

- Maurizio Grilli, Investment Director, Property Funds Research (PFR)