While COVID-19 has brought life sciences into the public eye, it has been a growth sector within Europe for many years, particularly in cities with strong science-based universities like Berlin, Cambridge, Dublin, London, Munich, Oxford, Paris, Utrecht and Zurich.

But what are the factors that are driving life sciences sector growth and significant interest in life sciences real estate (LSRE)?

There are several macro factors that are contributing to sector growth and, hence, attracting increasing volumes of real estate capital looking for a resilient growth sector and diversification.

Demographics: an increasingly elderly population

People are living longer, and this is driving continued development of preventative treatment, new drugs and advances in medical devices. But it is not just the general ageing of the population; it is the fact that the older cohorts are forming an increasingly sizeable proportion of the total population. In Europe, for example, the 80+ years of age cohort represented 5.8 per cent of the population in 2019. This is expected to rise to 11.3 per cent in 2050 and 14 percent by 2100.

Associated with an ageing population and the way people live their lives are lifestyle diseases, often resulting from a lack of physical exercise, an unhealthy diet, alcohol, drugs and smoking. Heart disease, stroke, obesity, cancer and more are all endemic in Western society. Providing solutions to these issues is driving R&D spend on drugs and treatments to extend life and improve the quality

of life for those suffering long- term afflictions. In parallel, the expansion of genetic research is delivering more tailored personal medicine solutions.

For governments, the ageing population can only mean one thing – pressure for higher health care expenditure. Eurostat data indicates that, with the exception of Greece, all European countries increased health care expenditure between 2012 and 2017, some by greater than 20 per cent. COVID-19 will have provided a further significant boost to spending in 2020/21.

Urbanisation and the war for talent

While there is still merit in purpose-built science parks in proximity to stand-out universities and the type of ecosystem that they entail, life sciences occupiers are giving an increasing amount of thought to the type of location and neighbouring occupiers that will stimulate innovation and create a competitive edge.

To this end we are seeing a move towards urban clusters that benefit from a crossover of life sciences and tech occupiers.

The vibrancy, amenities and services available within an urban cluster ecosystem are difficult to replicate on a more limited campus environment.

Successful life sciences businesses rely on attracting the brightest minds and skilled workers from the available talent pool.

The presence of retail, leisure and entertainment, heritage and culture, green space and urban living all contribute to making urban clusters a talent magnet for young professionals within the tech and life sciences industries.

Developers and investors are recognising the attractiveness of such urban ecosystems.

Technology

We are beginning to see a broadening of the occupier base, both in on-campus developments and within the urban clusters as the collaborative crossover between life sciences and tech accelerates.

The shift into preventative medicine, e-health and personalised solutions is being accelerated by the influence of technology and, in particular, the application of digital tech, artificial intelligence (AI), and machine learning.

This transition is generating new start-up and SME businesses that, in turn, drive demand for specialist and appropriately located real estate. Advanced analytics, automation and the cloud are enhancing decision-making and transforming manufacturing output and productivity levels.

Consequently, the real estate product must be adaptable to these changing technologies.

Sustainability

Life sciences facilities can often be high users of energy and water.

It is important for businesses to demonstrate a sustainable strategy to win the trust of governments, institutions and other stakeholders – long-term partners that will determine the success of the industry.

There are many examples of sustainable lab design coming forward that will provide long-term cost savings and environmental benefits.

However, given that the life cycle of a life sciences company may be very different to that of a, say, typical office tenant and that it may not see out its full lease term, flexible occupier solutions are required to ensure that buildings offer space and facilities just as attractive to the second-generation tenants as offered when new.

Funding

Funding is the lifeblood of new and growing life sciences businesses and the sums of venture capital (VC) being raised in the biotech sector has reached record levels.

Globally, €33.9 billion (£28.1 billion) was raised in 2021, an increase of 10 per cent over 2020. But the rising tide did not lift all boats and the UK had a better year than other European countries.

Fox Corporate Finance reports slightly higher 2021 figures for European investment in biotech at €7.2 billion (£6.1 billion), an increase of 49 per cent over 2020.

It also reports a significant 73 per cent growth in investment in the sector overall (Healthcare Services, HealthTech, MedTech and Biotech), with total funds raised of €13.9 billion (£11.5 billion).

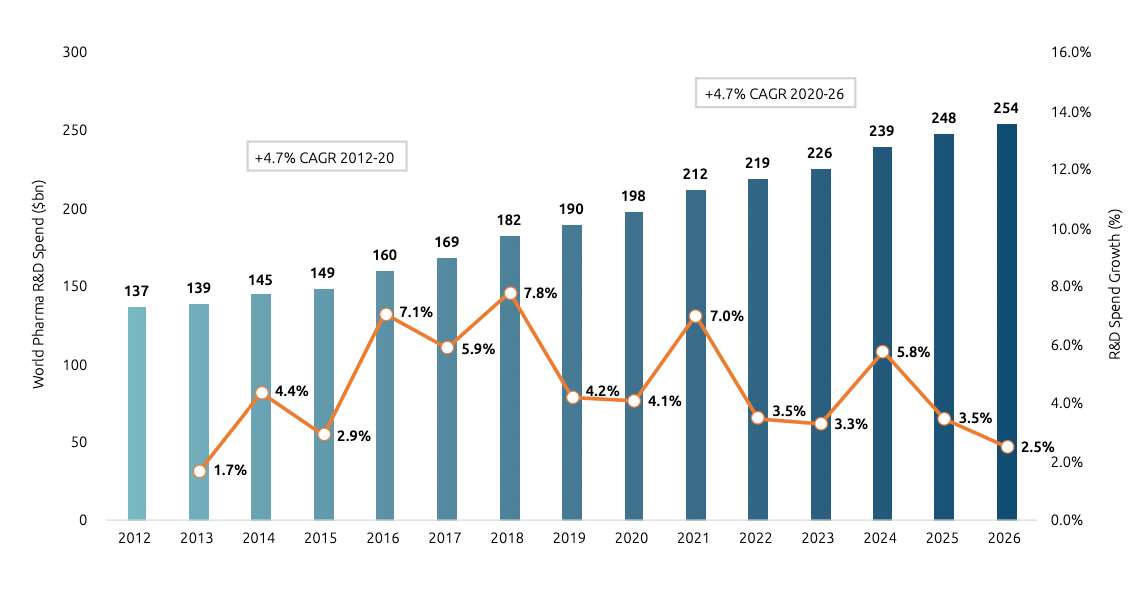

Global pharmaceutical R&D spend is forecast to grow at an annualised 4.2 per cent between 2020 and 2026 to reach €234 billion (£194 billion), a slightly slower rate than the 4.7 per cent annualised rate seen between 2012 and 2020 (see Figure 1).

However, the availability of finance enables smaller developers access to funds that facilitate significant research beyond just the big pharma companies.

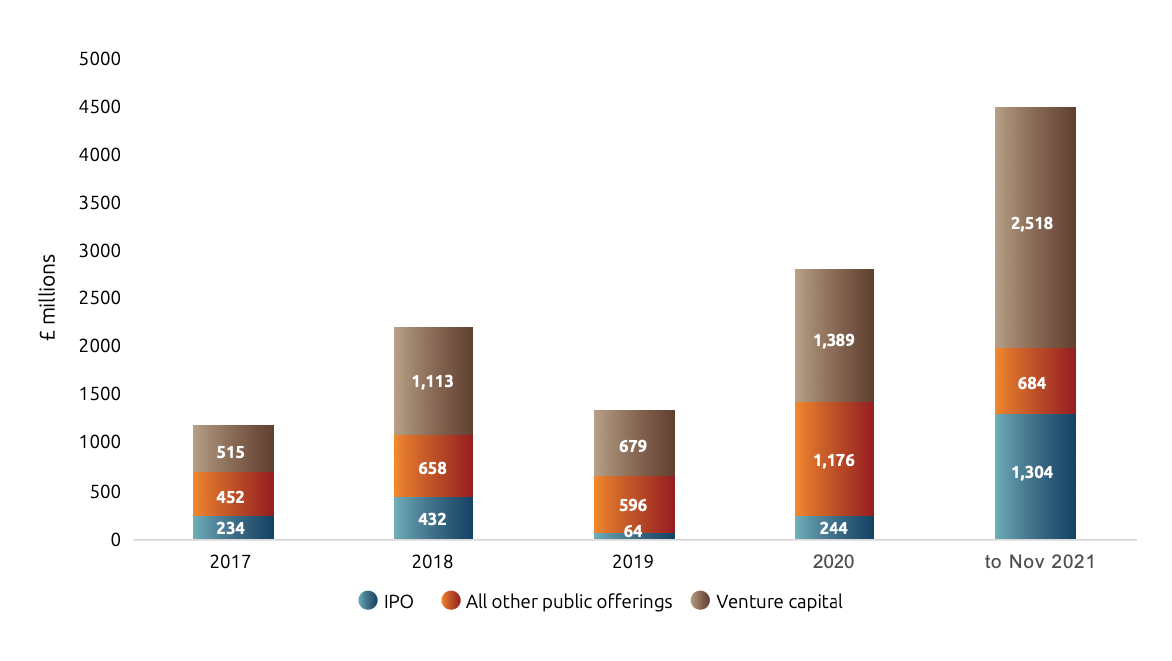

Taking the UK as an example, total funds raised by UK-based biotech companies have increased almost fourfold since 2017 to €5.4 billion (£4.5 billion, see Figure 2 below), with VC capital increasing fivefold and representing 56 per cent (€3.0 billion / £2.5 billion) of the total in 2021. The UK actually raised more VC funding than San Diego in 2021. Both domestic and global investors sought to capture a slice of the booming UK life sciences sector. A notable change to historic trends in 2021 was the marked increase in the number and scale of Initial Public Offerings (IPOs), representing 29 per cent (€1.6 billion / £1.3 billion) of funds raised. Listings of companies in the UK and US suggest an ecosystem reaching maturity with a strong pipeline of growing new businesses.

Note: Fundraising is based on the location of the company’s headquarters

Successful capital raising is bringing forward spinouts, start-ups, scale-ups and driving expansion. This is in turn driving strong occupier demand requirements for a range of appropriate real estate in specific locations where the talent pool and ecosystem overlap.

Real estate capital

While the US life science real estate market (LSRE) has grown to maturity, it is accepted that it is many years ahead of the UK and Europe in terms of its development of dedicated campuses and clusters. JLL transactions data shows the dominance of the US market, with deals in 2021 reaching close to €11 billion (£9.11 billion), which is an annual increase of 17 per cent. However, the last couple of years has seen huge interest from domestic and global real estate capital wishing to diversify and to gain exposure to the sector in Europe and particularly within the UK. UK LSRE transactions rose strongly in 2021, from €1.77 billion (£1.47 billion) to €2.93 billion (€2.43 billion) as investors were attracted by the sector’s resilience and limited supply.

For investors, not only does LSRE potentially tick the “S” box in their ESG objectives, but limited supply and a burgeoning demand in key growth markets is beginning to generate rental growth and clear rental premiums over standard offices for appropriate high-quality lab and lab/office space. There is always risk associated with an emerging segment of the market. But the maturity of the US market demonstrates what is possible – and the direction in which the UK and Europe are headed.

For those investors and developers prepared to build a deep understanding of the life sciences tenant base and their requirements, the opportunities and returns should prove attractive.